It’s Not Free

I’m going to go ahead and get this out of the way…your 401k./403b/IRA ( I will be using the 401k here as an example for the sake of brevity) is not free. Its not. Not Free. Got it? Good. Let’s move on.

Your retirement fund costs you money to administer, invest, and disburse, but do you know how much? Chances are you really don’t – these costs aren’t always published in clear language on your quarterly and annual statements. They aren’t because your broker would rather you not know.

The Fees

Your 401k has two main layers of costs: those imposed by the company managing the 401k and those imposed by the managers of the funds you invest in. You may have a Nationwide 401k, but your 401k is composed of funds by John Hancock or Prudential. Each of these has their own costs, as it costs money to manage both the investment account and those funds.

The company managing your 401k is going to impose charges because it costs them money to manage your account, send you statements, handle your disbursements, conduct trades…etc.

The company that owns the mutual funds or ETFs that you invest in will also charge you as they have to pay for the managers run those funds, their employees, their trading costs…etc.

Where Do I Find These Fees?

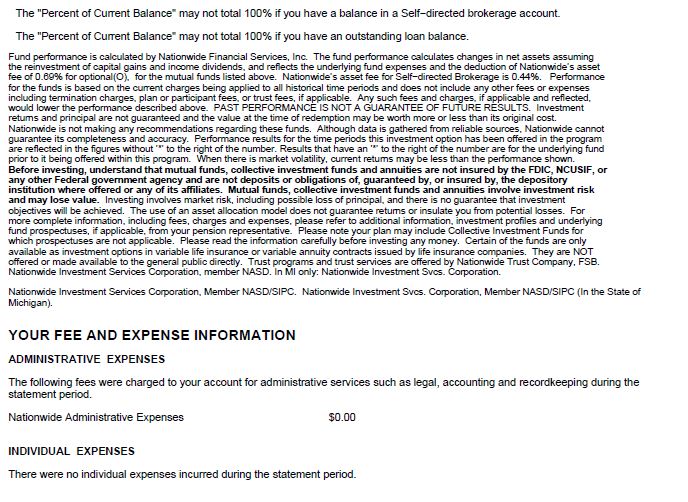

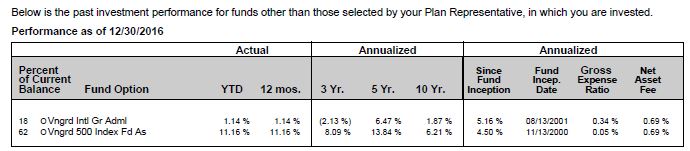

Excellent question – you can start with your quarterly or annual statement. Buried inside there, usually in small print will first be the amount that the company managing your 401k charges you for that privilege. I happen to have a 401k with Nationwide and I’ll provide an example from one of their statements:

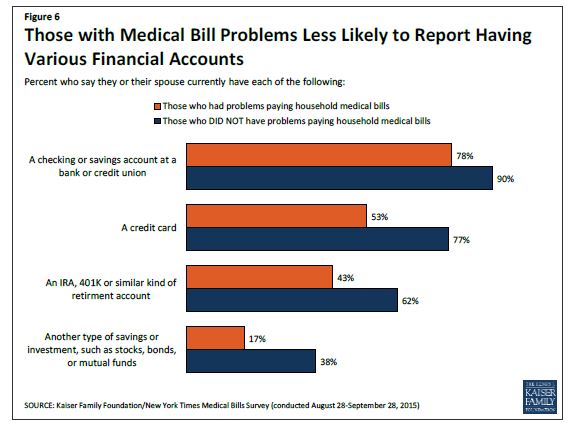

Were you able to find it? The fee in question isn’t that Administrative Expense section. That may have gotten your attention first because it was the easiest to read. Look closer at the paragraphs prior to that and you will find a statement with the following:

"Fund performance is calculated by Nationwide Financial Services, Inc. The fund performance calculates changes in net assets assuming

the reinvestment of capital gains and income dividends, and reflects the underlying fund expenses and the deduction of Nationwide’s asset

fee of 0.69% for optional(O), for the mutual funds listed above. Nationwide’s asset fee for Self−directed Brokerage is 0.44%."

These are the actual fees for the 401k in question and are usually referred to as “Asset Fees”. In this case there are actually two different types of fees for the 40k management:

- 0.69% for optional funds or stocks

- 0.44% for the Self-directed Brokerage.

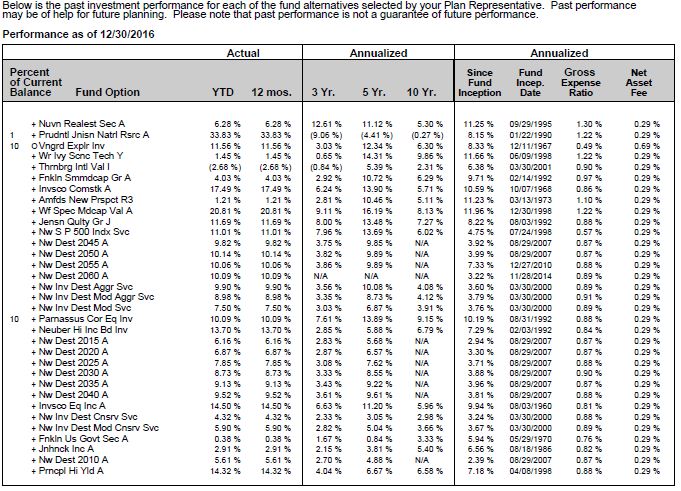

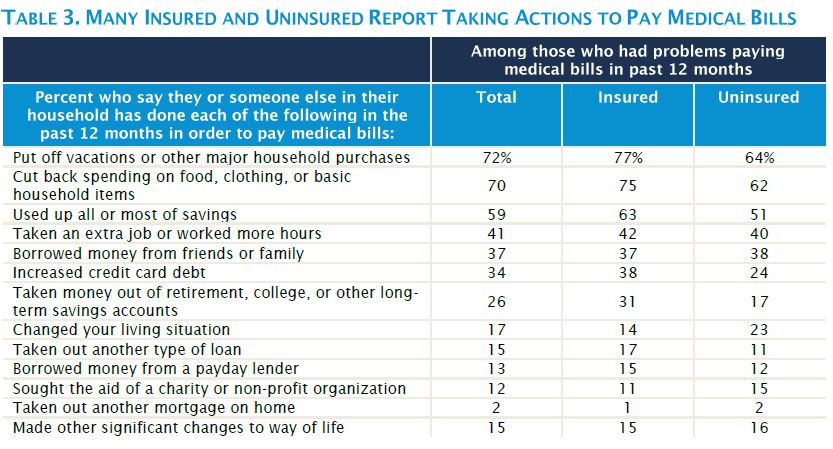

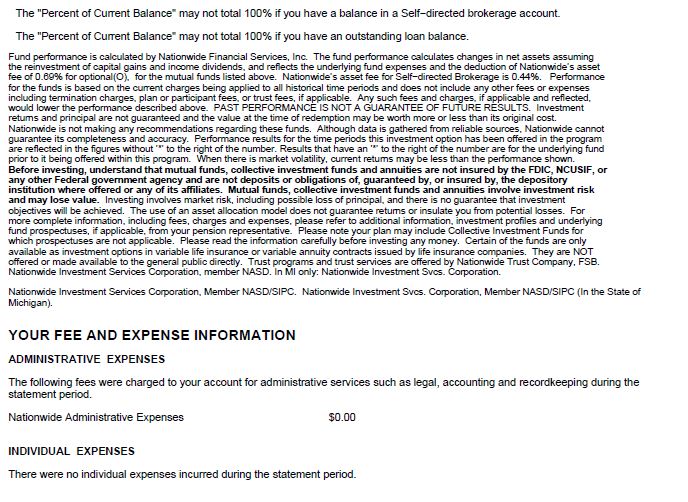

When your company hands you a stack of paperwork for your 401k, among it will be a listing of preferred funds or ETFs chosen by the 401k provider. See this example below:

Notice the sentence “Below is the past investment performance for each of the fund alternatives selected by your Plan Representative”. Your plan representative chose the core basket of funds for you to choose to invest in – and since these were chosen by the rep for Nationwide they will be charged the lower amount of 0.44% for “Self-directed Brokerage”.

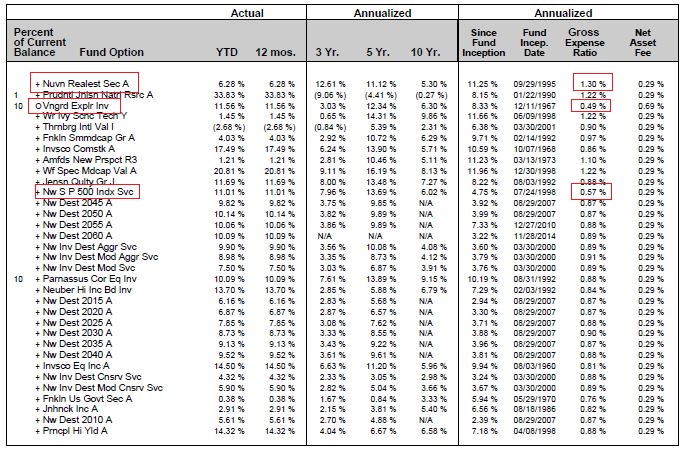

However, Nationwide (but not all providers) offers the investor the option to choose their own funds or stocks outside of those chosen by the Plan Representative:

For these funds, Nationwide will charge you 0.69%, 0.25% higher than the standard option.

What Does the Percentage Mean?

Before we go any further, lets figure out what that percentage actually means. Lets assume that we had a good quarter and your funds made a 10% return. The managers of your funds and the company managing your 401k will take a cut off that return. So if we had a Vanguard S&P 500 Index Admiral Shares fund, Nationwide would take 0.69% of the 10% – giving you a 9.31% actual return.

It is important to remember that we are investing over the long term here, typically decades. 0.69% or 0.44% may seem like insignificant numbers by themselves but when taken over the course of 35 years, it really adds up. This example from the Department of Labor does a nice job of explaining it:

Assume that you are an employee with 35 years until retirement and a current 401(k) account balance of $25,000. If returns on investments in your account over the next 35 years average 7 percent and fees and expenses reduce your average returns by 0.5 percent, your account balance will grow to $227,000 at retirement, even if there are no further contributions to your account. If fees and expenses are 1.5 percent, however, your account balance will grow to only $163,000. The 1 percent difference in fees and expenses would reduce your account balance at retirement by 28 percent.

So over the long run those small percentages do take a significant chunk out of your investments. Onto the second round of fees.

Expense Ratio

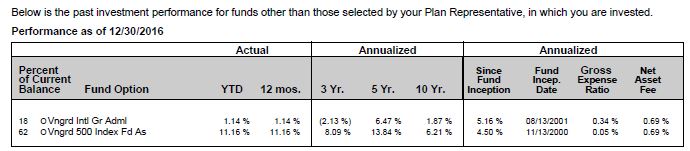

The fees that are charged by your fund or ETF providers are generally called the “Expense Ratio”. These are charged in addition to the ones charged by the company managing your 401k and are on a fund by fund basis.

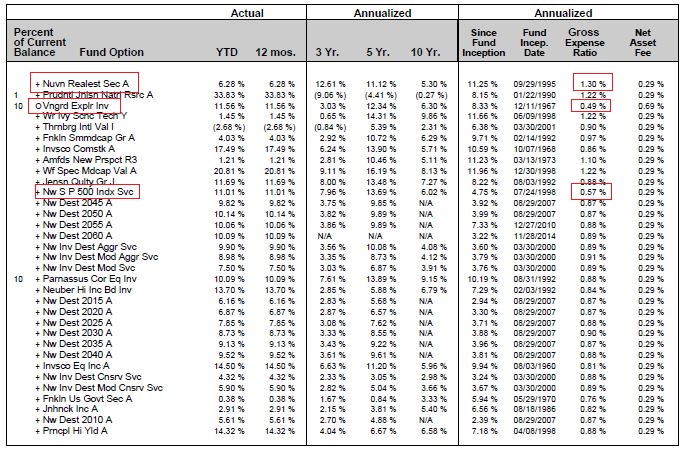

Note that column that says “Gross Expense Ratio” (charged by the funds themselves) and how it is different for each fund, versus the “Net Asset Fee” (charged by Nationwide). They can vary quite drastically – from a low of 0.49% for the Vanguard Explorer (line 3) all the way up to 1.3% for the Nuveen Real Estate Securities (line 1). Typically funds that specialize in specific areas such as real estate, natural resources, or technology have greater expense ratios versus those that reflect the general market such as an Index Fund (see Nationwide S&P 500 Index Fund Service Class, line 11 @ 0.57%).

So if we invested in that Real Estate fund at the top – our total cost for that investment would be 1.30% + 0.29% = 1.59%. This means that we would lose 1.59% every year from our returns from that fund. If you add in the standard rate of inflation at ~ 1.37% (in 2016), the fund would have to return least 2.96% before we saw any actual profit.

Compare this with the Vanguard S&P 500 Index Admiral Shares fund from our optional funds, which has an expense ratio of the rock bottom price of 0.05%, but a net asset fee of 0.69% for a total of 0.74% – more than half the cost of the real estate fund. This option is also cheaper than the Nationwide S&P 500 Index Fund Service Class which has a total cost of 0.57% (for the same exact product!) + 0.29% = 0.86%. They are really the exact same product – both of these funds are invested in the same basket of stocks that compose the S&P 500, one just happens to be cheaper than the other.

As a note, it is generally better to go with the low cost index funds. This is a hot topic in itself, but over the long term these will almost always outperform the other funds with a much lower cost and legendary investor Warren Buffett happens to agree with me. However, having a diversified portfolio is always the best course of action, but watch those fees! They may not be worth the returns that you are seeing.

What to Watch Our For

Its important to take these fees into consideration when choosing funds. As a rule, those specialized funds will cost more than index funds – and if you choose index funds be sure to choose the cheapest option you can find. One S&P 500 Index fund is going to be 99.9% similar to another, but chances are the costs will be different.

Watch out for any fund that has an expense ratio greater than 1.00%. Most likely that in the long run you’ll lose out on more returns for these expensive funds versus a lower cost option. Our real estate fund was hot up until 2008, but then had some pretty disastrous returns compared to the S&P 500 index. They may be useful in the short run, but stick with the cheaper indexes in the long run.

When planning your retirement it is important to remember that you have a lot of options available inside your financial toolbox – and annuities play an important part. Some people may feel very comfortable directing their own investments inside a 401k, 403b, or IRA and some people may not due to the fact that they may have any experience with investing or financial products. There are products out there for each person and one isn’t necessarily better than the other – it depends on each person’s unique situation.

When planning your retirement it is important to remember that you have a lot of options available inside your financial toolbox – and annuities play an important part. Some people may feel very comfortable directing their own investments inside a 401k, 403b, or IRA and some people may not due to the fact that they may have any experience with investing or financial products. There are products out there for each person and one isn’t necessarily better than the other – it depends on each person’s unique situation.